My car insurance for teens blog 1693

How Does Car Insurance Cover Rental Cars? - Njm can Save You Time, Stress, and Money.

Your cars and truck insurance supplier may have a list of preferred vehicle body shops in their network for you to pick from to get your vehicle repaired. Be sure to get any damage fixed ASAP to make certain you stay safe on the roadway (for example, your automobile may still be drivable but you want to make certain it's safe and legal).

Once everything is settled, you desire to examine your car insurance coverage to make certain your policy still fits your needs. If you were found to be at fault for the accident, it's likely your vehicle insurance premium will increase when it's time to renew, which can be a good time to shop around for car insurance coverage. cheaper car.

So let's state you had a $1,000 deductible, and the damage to your cars and truck would cost $3,000; your cars and truck insurance coverage service provider would cover $2,000 for the repair work. It is necessary to know just how much your deductible is and what type of coverage you have, such as accident coverage or comprehensive coverage.

Do I need to file a car insurance coverage claim? Yes, in the majority of cases, it is encouraged to submit a vehicle insurance claim.

When do I file a vehicle insurance claim? You need to submit a claim if there has actually been a mishap or injury including another celebration as soon as possible.

The automobile insurance claims process should preferably be easy to handle, but often, it can lead to a great deal of back and forth. That's why Metromile set out to produce a car insurance coverage claim treatment that is various from the rest (perks). How cars and truck insurance declares work with Metromile, Traditional automobile insurance provider deal with submitting a claim in a different way than Metromile.

AVA can assist identify what actually occurred and link you with local repair work shops or rental cars and trucks for your convenience. Because when you're in a position when you need to submit a claim, the last thing you require is to include any more tension to your plate.

No one wants to file a claim or enter a mishap, however your automobile insurance coverage is developed for situations similar to this and helps secure you and ensure you can proceed with your life. If you're questioning how do cars and truck insurance claims work, now you have a better concept of the insurance claims procedure with this breakdown.

An Unbiased View of Does Car Insurance Follow The Car Or The Driver?

The subject of insurance can be made complex, however it is essential you understand how and when our policies cover you and your passengers in case of an occurrence. The following is a summary of how our insurance policies work. Keep in mind: Only one policy uses when the motorist is taken part in either Rideshare or Lyft Deliveries Providers. insurers.

Lyft might likewise provide first-party coverages such as medical payments (Med, Pay) or individual injury defense (PIP). The availability of first-party injury protection and the coverage limits vary by state (money).

Keep in mind: All policies may be customized to abide by specific city or state insurance coverage requirements. Uninsured/underinsured vehicle driver coverage covers injuries to you and your passengers in a covered occurrence triggered by a motorist who lacks sufficient insurance coverage - perks. First-party coverage uses to healthcare or medical expenditures if you are hurt in a covered mishap.

Express Drive occupant's insurance protection depends upon which of the following 3 durations you're in when an event occurs: Individual driving: You're offline (i. e. not in chauffeur mode)Awaiting a request: When the app is in chauffeur mode and you have not received a ride demand. Trip in development: This includes whenever from accepting a ride demand till the time the flight has actually ended in the app.

These coverages are readily available in all states in the U.S., except for those trips stemming in New york city City with a TLC (Taxi and Limo Commission) driver. Some areas might have specific requirements that customize the explained protection. We're devoted to pressing the insurance industry to create innovative services for our drivers.

Please call your individual car insurer to find out what policies are offered to you. In choose regions, Lyft (through Lyft Center, Inc.) has actually partnered with insurance providers to offer rideshare insurance plan at affordable rates - laws. These automobile policies cover your automobile both when you're driving for rideshare, or driving for personal usage.

Before starting your trip, DISB uses some things to bear in mind about vehicle insurance coverage and rental cars and trucks prior to for your summertime journey. Make certain your insurance recognition card remains in the cars and truck. Double-check that contact number for your insurance provider and agent are noted on the recognition card. If not, make note of these numbers to keep with your ID card and bring it with you.

If you are effectively insured on your own vehicle, you might consider forgoing this extra liability security (vans). This extra insurance coverage can cost $7-$14 a day. deals coverage to the tenant and guests for medical costs resulting from a car crash. If you have adequate health insurance and disability income insurance, or are covered by injury security under your own cars and truck insurance coverage, you will likely not need this extra insurance.

Getting My Should You Get An Extended Warranty For Your Car? To Work

attends to the theft of individual products inside the rental cars and truck. If you have a house owners or renters insurance coverage, it generally covers this currently (affordable car insurance). If you often travel with pricey fashion jewelry or sports equipment, it may be more affordable to buy a floater under your house or occupants insurance plan so the products are fully secured when you take a trip.

g., a week, a month or more), there may be restrictions on the protection your existing auto insurance policy provides. Contact your insurance provider or agent for details. If you do not own a cars and truck, you may wish to think about purchasing a non-owner car insurance coverage, due to the fact that it supplies benefits in addition to protection for a rental cars and truck. money.

Your cars and truck insurance deductible is typically a set quantity, say $500. If the insurance adjuster identifies your claim quantity is $6,000, and you have a $500 deductible, you will receive a claim payment of $5,500. However, based upon your deductible, not every car accident warrants a claim. If you back into a tree leading to a small dent in your bumper, the expense to repair it might be $600.

Deductibles vary by policy and motorist, and you can select your automobile insurance coverage deductible when you buy your policy (cheaper car insurance). It's necessary to take a look at deductible options when you compare vehicle insurance policies to see which is your best choice. Drivers trying to find the most affordable cars and truck insurance should increase deductibles when they're getting a quote, however they ought to also understand they may need to pay more cash out-of-pocket in the occasion they make a claim.

Compare quotes from the top insurance provider. Which Auto Insurance Coverage Types Have Deductibles? Just as there are various kinds of vehicle insurance protection, there are differing deductibles based upon those different kinds of coverage. It's important to comprehend how much the vehicle insurance deductible is for each type, so you'll know what you're anticipated to pay in case of a claim.

Liability vehicle insurance protection does not have a deductible. This protection pays your expenses if your cars and truck is damaged by something aside from a collision with another automobile or item. This might include fixing damage from hail, hitting a deer or replacing a cracked windshield. It also will pay to cover the expense of changing taken products.

This coverage pays for repair work to your vehicle when you are at fault. This might be when your automobile is harmed in an accident with another vehicle or an object such as a tree or wall. This deductible is typically the greatest deductible you will have with your car insurance plan.

Because case, you would not pay a crash deductible. Individual injury defense coverage pays the medical expenditures for the motorist and all guests in your cars and truck. Uninsured motorist coverage pays your expenses when you remain in a car mishap with a chauffeur who is at fault but does not have insurance or is insufficiently guaranteed to cover your costs. auto.

Some Ideas on Insurance Coverage While Driving With Lyft You Should Know

Due to the fact that consumers pick varying types of vehicle insurance coverage with various monetary limitations, deductibles can vary significantly from one driver to the next. According to Cash, Geek's information, the typical vehicle insurance deductible amount is approximately $500 - auto insurance.

You can save an average of $108 per year by increasing your deductible from $500 to $1,000. For those with tight spending plans, choosing a lower premium and a greater deductible can be a way to ensure you can pay for your automobile insurance coverage - auto insurance. If you can afford it, paying a greater premium might suggest you do not have to come up with a lot of cash to pay a lower deductible in the event of an accident.

It's important to have your questions concerning car insurance coverage deductibles responded to before that occurs, so you know what to expect. When there's an automobile mishap, the at-fault chauffeur is needed to pay the vehicle insurance deductible.

If the at-fault chauffeur does not have insurance coverage or adequate insurance coverage to cover the other motorist's expenses, the no-fault chauffeur can use his car insurance coverage as secondary coverage to pay the expenses. car. When do you pay a deductible if you are needed? Generally, if you are needed to pay a car insurance deductible, the quantity of the deductible will be subtracted from your claim payment when it is provided.

Can you avoid paying a deductible? Essentially, the only method to prevent paying a cars and truck insurance coverage deductible is not to sue (vans). Otherwise, if you sue, expect to pay the deductible. While liability protection does not need a deductible, this coverage pays the other motorist's expenditures for injuries and repair work, not your own.

Compare quotes from the top insurance companies. Key Points About Cars And Truck Insurance Deductibles, If you have car insurance coverage, you will have to pay a vehicle insurance deductible when you sue for repairs and injuries. How much you pay for your deductible depends upon your cars and truck insurance coverage and how much your automobile insurance coverage premium is. low cost auto.

The at-fault chauffeur in the accident is normally needed to pay an automobile insurance deductible. Liability coverage does not need a car insurance deductible, however only covers the costs of the other driver, not your own - cheapest car. About the Author.

https://www.youtube.com/embed/4OAqh3yeB84

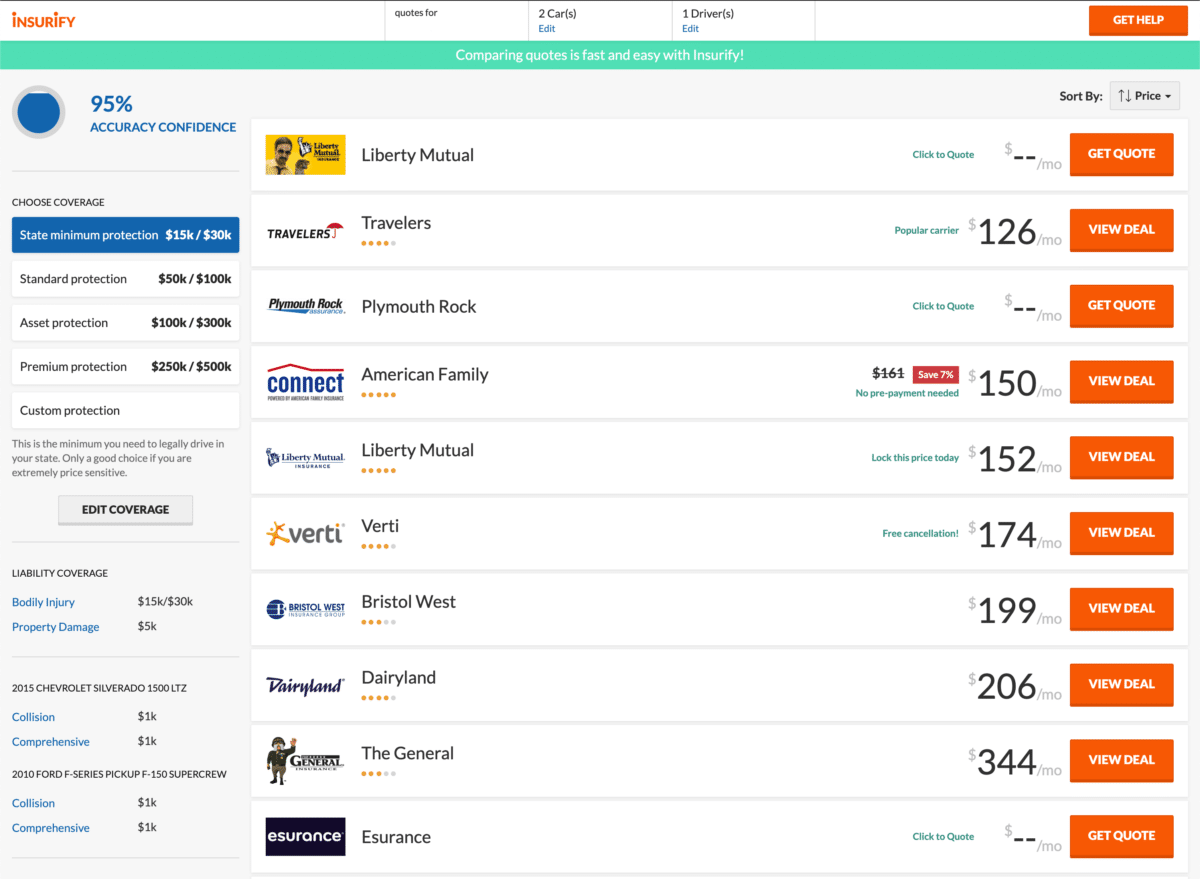

These consisted of automobile insurance rates by state, insurance carrier and lorry manufacturer, in addition to the chauffeur's age, driving record, gender (where allowed), to name a few elements. This data could assist you approximate just how much your automobile insurance policy may cost based on your location and personal profile, and determine which car insurance carriers best align with your budget plan and protection requirements.

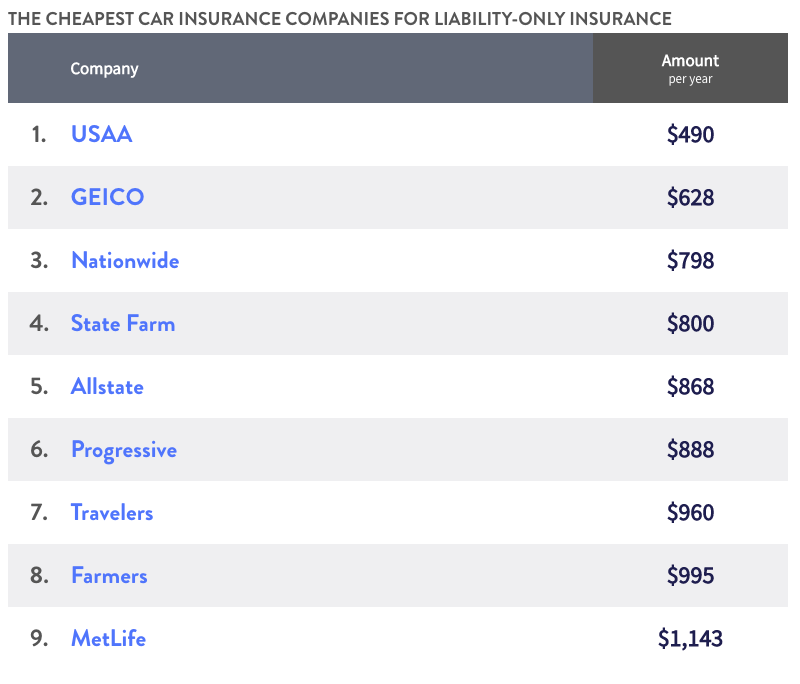

Some Known Questions About The Cheapest Car Insurance Companies For Every Type Of ....

At the end of 2021, numerous cars and truck insurers got approval to trek their rates in numerous states and premiums are expected to keep increasing this year. And with costing US families and, it's more essential than ever to discover. One such way to conserve is to find a provider with cheaper rates than what you presently have (auto).

And while affordable policies exist, it's crucial to stabilize cost savings with appropriate coverage (cheaper auto insurance). If you enter a mishap, for example, you may end up paying more than you would have with better, more costly protection. That said, there are inexpensive alternatives out there with great protection at low rates.

Finest low-cost cars and truck insurance companies Geico's advertising existence has actually made it one of the most identifiable brands in auto insurance, and this insurance coverage company's costs and consumer service have made it one of the most precious. cars. Geico notoriously informs chauffeurs that they could conserve 15% or more by changing to the carrier, however how does it supply such savings?

The General acknowledges that not every driver can boast the cleanest record, and that errors-- such as accidents and driving violations-- take place behind the wheel - car insurance. Still, the business endeavors to offer reasonable rates to chauffeurs who may fall under the "nonstandard" label - cheapest car. It's also worth keeping in mind that insurance acquired through The General is underwritten by a variety of companies that have been recognized by AM Finest with an "A" ranking, while The General itself has actually acquired an A- (exceptional) rating. cheapest.

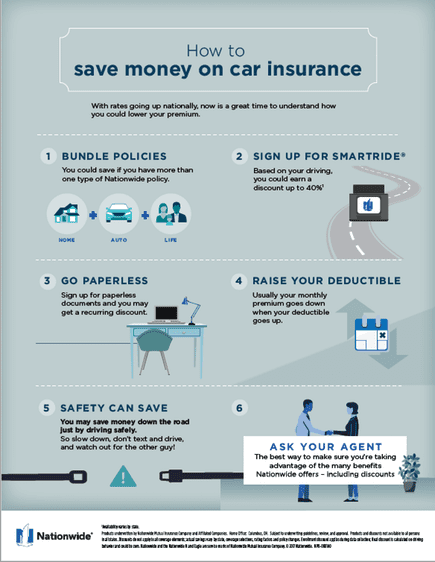

If you can deal with an insurance coverage business you currently utilize for other insurance coverage, or an insurer that uses unique advantages to employees at your workplace, you can potentially conserve even more money on your auto insurance plan (suvs). You may have the ability to save money on your insurance coverage premium by changing your coverage or deductibles, but it may be advantageous to talk to an agent prior to making modifications so that you better comprehend how your coverage will operate in the event of a mishap - cheap car.

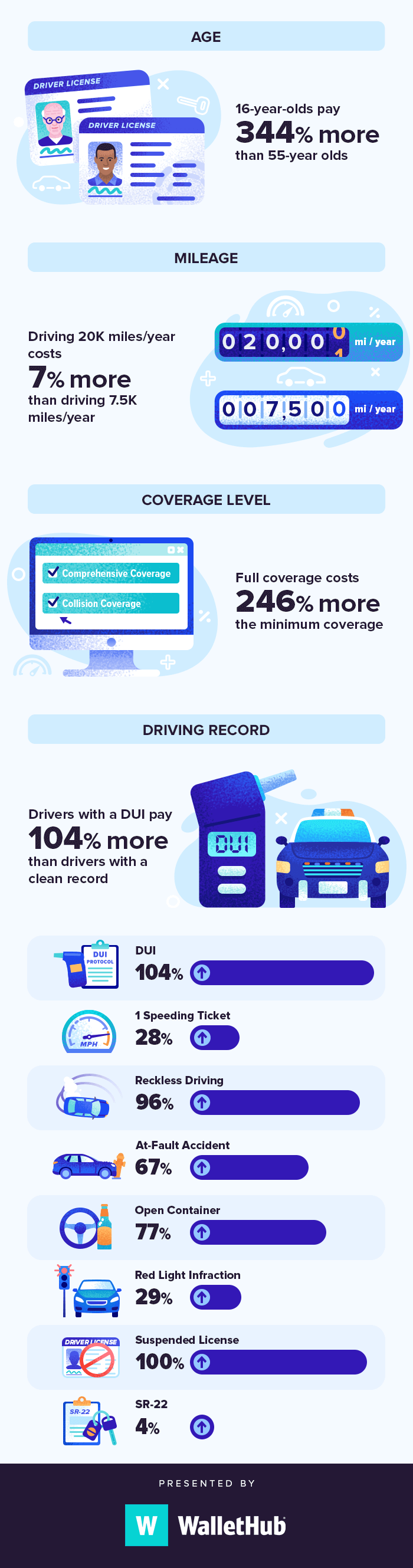

What identifies your car insurance coverage rates? Aside from varied prices from insurance suppliers, lots of elements influence the cost of your automobile insurance coverage, including: Your age (in all states except Hawaii)Driving history, Credit history (in some states)The quantity of protection you seek How can I decrease my insurance rates? Discovering a car insurance provider that can save you money is important, but there are things you can do on your own to guarantee you conserve money on automobile insurance. cheapest auto insurance.

Nevertheless, we may get settlement when you click links to product and services offered by our partners. low-cost auto insurance.

Conserve Cash with Low-cost Automobile Insurance coverage Are you looking for inexpensive auto insurance coverage however anxious about compromising quality and service in favor of a more budget-friendly rate? GEICO has you covered (trucks). The word "inexpensive" may be scary when it pertains to a car insurance plan, but it does not have to be in this manner. affordable auto insurance.

Some Known Details About Cheap Car Insurance: The Most Affordable Companies In 2022

It's budget friendly. All while offering you with 24/7 client service and top-of-the-line insurance coverage for your car. Here at GEICO, quality doesn't fall by the wayside when it comes to providing clients with affordable vehicle insurance and terrific client service.

Are there runs the risk of to getting low-cost car insurance coverage? Cheap rates ought to not mean you need to opt for limited policy protection options, high deductibles, poor customer care, and a lack of essential security functions like emergency situation roadside service - cheapest auto insurance. Things are different with GEICO, where inexpensive vehicle insurance coverage doesn't alter the remarkable service, features, and coverage options that our vehicle insurance coverage policyholders receive (cheaper).

GEICO insurance policy holders are surrounded by money-saving opportunities that can make their car insurance rates more affordable.: By changing to GEICO, trainees could save $200 on a car insurance coverage policy. We work hard to make sure "inexpensive" just explains your automobile insurance coverage rates and not the quality of service or your experience as an insurance policy holder.

The Buzz on How To Switch Car Insurance - Policygenius

/images/2020/04/22/happy-family-driving.jpg) trucks car insured insurance affordable cheap car

trucks car insured insurance affordable cheap car

Pick When to Switch Car Insurance policy There are 2 main reasons most people desire to switch auto insurance: Either their premiums are too expensive or they're dissatisfied with the business itself. (If it's the second one, below's a hint: It's constantly the best time to quit working with a crappy firm!) Let's go back to that other reasonprice.

Premiums can additionally slip up slowly over time. There's absolutely nothing worse than a weird premium, so it's good to search for better prices yearly. Below's something you might not have thought of: Occasionally, major life occasions impact your premiumsand the company that was giving you the ideal bargain previously isn't any longer.

Confirming your current policy currently will certainly assist you know what to look for when you begin shopping for a brand-new one. It's kind of tough to shop for something when you do not also recognize what you require.

Are you just bring the minimal responsibility insurance policy? (You require much more - cheap auto insurance.) Did you acquire crash however not detailed!.?.!?( You may need both.) Identify if you have any type of spaces in insurance coverage or various other things you wish to change, and also make a buying listing. Make A Decision Just How Much Coverage You Required (as well as What Kind) A lot of people do not understand how to switch over automobile insurance policy due to the fact that they don't actually recognize what they need to get.

insurance prices cheap credit score

insurance prices cheap credit score

cars vehicle insurance money prices

cars vehicle insurance money prices

Window shopping is your point. This is where you shine. So the thought of obtaining quotes from five, 6 and even 10 insurance coverage companies does not trouble you. You simply would like to know that you're obtaining the best offer, whatever it takes. liability. Free of cost spirits, this appears like absolutely no fun. In fact, you just bore in mind that you have to go do that point, as well as you far better leave right now or you're mosting likely to be late - low-cost auto insurance.

Whew, that was close! You nearly had to purchase cars and truck insurance. Ew (cheaper car). Geeks, listen upthe free spirits are! Buying around for vehicle insurance coverage is a great deal of work. And also if you're being totally straightforward, it's not the very best use your time. Cost-free spirits, the geeks are right too.

Basics Of Auto Insurance - Mass.gov for Dummies

These independent insurance policy agents are professionals on exactly how to change auto insurance coverage. They'll do the hard job for you, so you can get the finest prices and also save hrs of time you would've spent getting your very own quotes.

credit score vans dui money

credit score vans dui money

That means you reach support a local businessnot a huge company that treats you like a number on a spreadsheet. money. Discuss With Your Old Insurance Company (If You Want) We like an excellent bargainand obtaining an excellent bargain starts with requesting one - dui. If you got a low quote and also your only grievance concerning your present insurer is the cost, inform them what the various other guys are providing.

(Certainly, if you hate your insurance provider and are just over it, it's totally all right to skip this action and also carry on to the next one.) Look For Cancellation Costs We understand, it's horrible for the insurance provider to make one last grab at your wallet as you go. vehicle insurance.

If they're going to bill you an arm as well as a leg to cancel your plan, it may not deserve switching over right this 2nd. Instead, wait till it's virtually time for your policy to expire. Purchase a plan with the new company and allow the old policy end on its own.

Prior to you commemorate also hard, make sure the old policy is really terminated. Some insurance policy business let you do this over the phone.

Inspect their regulations as well as follow them to the letter (word play here meant). Your old insurance will certainly be canceled and also you'll be ready to ride off right into the sundown with your new insurance policy in hand.

Things about Switching Insurance Companies - How And Why To Do It

5 - cheapest auto insurance. Verify There Are No ChargesEsurance recommends inspecting for charges connected with switching your plan. If you finish your coverage period, there should not be any fees or fines. If you want to cancel early, it's vital to make sure you won't have to pay a charge to do so.

Regularly Asked Questions concerning Switching Your Cars And Truck Insurance coverage, When changing your automobile insurance coverage, there are a couple of points to think about. Right here are a few of the most commonly asked inquiries concerning exactly how to transform automobile insurance coverage: Just how Often Must I Revisit My Policy?Bankrate recommends assessing your plan at the very least yearly (perks).

Your insurance coverage rates might change as your monetary situation and also driving history adjustment. It's easier than ever to compare quotes, with the alternative to do all of it online. Can I Switch My Insurer While Having an Open Claim?According to The Zebra, it's possible to transform auto insurance coverage companies while having an open insurance case (vehicle). When your car insurance policy premium comes due, you might be wondering if you could obtain a far better offer in other places. Changing to a brand-new auto insurance business can be a great way to conserve you money and get you much better insurance coverage. Some companies also supply motivations to individuals who switch over by providing a discount. We'll cover the steps you need to require to conveniently switch over vehicle insurer and help you figure out just how to terminate your current one. 5 Actions to Changing Cars And Truck Insurance Policy Companies Switching Over cars and truck insurance policy is pretty easy once you recognize the appropriate actions to take. Right here are our tips for switching car insurer: 1. 5. Terminate your old insurance policy Offer your old automobile insurance firm a call or start the procedure online.

Just how to Terminate Your Old Cars and truck Insurance Firm's Policy Generally, you'll have to call to terminate your old insurance coverage. To cancel your policy, there are a few points Browse this site you'll require to give, including the end day of the old insurance coverage policy this will certainly be the efficient day of your brand-new insurance policy. If you're purchasing new auto insurance with a reliable day of April 4, inform your old car insurance to terminate your initial plan reliable April 4.

An Unbiased View of Do Men Really Pay More For Car Insurance? - Insurancequotes

The only time most of us think regarding our vehicle insurance policy is when there is bad information, like a ticket or a mishap. When you're young, single and also incident-prone, prices only seem to go one method: up - low-cost auto insurance.

Secret TAKEAWAYSCar insurance costs can enhance for different reasons, yet there are numerous points you can do to offset the boosts. Some big life adjustments, like getting a home and obtaining married can lower auto insurance coverage expenses.

IN THIS ARTICLELife happens: 16 methods to reduce automobile insurance policy, If you don't wish to await your cars and truck insurance prices to drop, the great news is that there are actions you can take now Additional info to minimize automobile insurance (cheaper car insurance). Desire to recognize even more? Here are 16 different techniques to attempt.

You don't have to stick with the very same insurance company. Occasionally going shopping around for the ideal bargain on vehicle insurance is a wonderful method to pay less.

Get discounts for installing anti-theft tools, Car insurance provider enjoy to give discounts to customers that take steps to lower their risk as motorists - cheaper car. One means to do that is by mounting gadgets that can hinder thieves or make your cars and truck less complicated to recoup if it is swiped, such as an automobile alarm system or GPS monitoring.

Insurance providers like data, and also data programs that married chauffeurs get in fewer mishaps. Even you marry a partner that does not drive, your prices can still drop considerably about on average.

Some Of Teenage Car Insurance: What To Know - Trusted Choice

Ask your auto insurance provider what types of affinity group price cuts it provides - accident. Miss month-to-month costs settlements, Setting up your vehicle insurance policy premium to be billed month-to-month may be easier to spending plan, yet if you can pay for to pay a larger piece at once, it could save you cash (dui).

Acquire a house, Insurers think about homeowners more stable than tenants, so most will certainly discount your price, regardless of whether you insure your house with them or not. The savings commonly are reflected in your automobile insurance coverage bill.

Relocate to a small community, If you choose to ditch the huge city for a community with more room and less individuals, it might profit your automobile insurance coverage rate, too. Outside of your very own driving document, few things have a lot more effect on auto insurance policy than your ZIP code - suvs. Much less populace density generally implies less accidents.

It doesn't occur overnight, however it does occur, Huge modifications in your life generally indicate huge adjustments in your insurance. "It's not usually one firm will offer the finest offer in all situations," states Penny Gusner, elderly customer analyst for Insurance.

low cost auto insurance cheapest vehicle insurance

low cost auto insurance cheapest vehicle insurance

Just how can I lower my cars and truck insurance policy after a mishap? The trouble is that if you're in an at-fault mishap, or your insurer thinks you have actually been included in way too many events, your insurance coverage premium will likely rise. One at-fault occurrence, for example, can increase your rate anywhere from, depending upon the extent.

cheaper car insurance car insured car money

cheaper car insurance car insured car money

However, your price might still increase due to shedding a good motorist discount rate (cars). Just how much does cars and truck insurance policy drop after 1 year with no insurance claims? If you're a risk-free driver and also haven't submitted any type of cases in the in 2015, your cars and truck insurance policy prices may go down at renewal or might remain the very same.

An Unbiased View of What Age Does Car Insurance Go Down? - Progressive

Nevertheless, it's possible that your vehicle insurance policy costs can rise also if you do not have a crash or make an insurance claim throughout the entire plan term. affordable car insurance. When will my automobile insurance coverage decrease? Insurer will certainly typically cut your rates when you transform 25, however this is not always the case.

However if you're a secure vehicle driver, you can see a decrease in your auto insurance policy prices at plan revivals as well as premiums might drop even before 25 (cheaper cars). Why did my insurance drop? If you've been with your vehicle insurance provider for three or more years, they may agree to supply discounts that weren't noted during the quote procedure.

car cheap car insurance cheapest vans

car cheap car insurance cheapest vans

You may anticipate a rise prior to seeing a decrease in rates. Does vehicle insurance policy reduction in time? Yes, automobile insurance coverage decreases over time. You may locate that your automobile insurance coverage prices drop as you age or have teen chauffeurs aboard. As well as you could obtain discounts if you take out insurance with the exact same company for 3 to five years.

dui auto cheap insurance cheap insurance

dui auto cheap insurance cheap insurance

Being inexperienced behind the wheel of a vehicle normally leads to greater insurance prices, yet some companies still supply great costs. Much like discovering insurance for any various other vehicle driver, discovering the most effective vehicle insurance policy for new chauffeurs indicates doing study and also contrasting costs from suppliers. In this write-up, we at the House Media evaluates team will offer you a summary of what new vehicle drivers can expect to pay for auto insurance coverage, who certifies as a brand-new motorist and what variables form the cost of an insurance plan.

That is taken into consideration a new motorist? Each state sets its very own minimum auto insurance coverage requirements, and car insurance for new motorists will look the exact same as any kind of various other vehicle driver's plan. While an absence of driving experience doesn't change just how much insurance coverage you require, it will certainly influence the price. affordable. Right here are some examples of people that can be considered new vehicle drivers: Teens Older individuals without a driving record Individuals that come in to the united state

Auto insurance coverage rates by supplier Auto insurance for brand-new drivers can vary commonly depending on where you shop (trucks). Below are several popular providers' average annual prices for complete coverage insurance coverage for a 24-year-old with a great credit scores ranking and also an excellent driving document. Vehicle insurance for teens It can be exciting for a teenager to start driving on their very own for the very first time, but the expense of automobile insurance for brand-new chauffeurs is commonly high.

The 3-Minute Rule for Commercial Auto Insurance Cost - Insureon

If you have a background of having car insurance coverage plans without submitting claims, you'll get less expensive prices than somebody that has actually submitted cases in the past.: Automobiles that are driven much less frequently are much less likely to be entailed in a crash or other destructive occasion. Automobiles with lower annual mileage might get somewhat lower prices.

cheap car insurance insure risks cheapest auto insurance

cheap car insurance insure risks cheapest auto insurance

To discover the best vehicle insurance coverage for you, you must contrast shop online or speak to an insurance coverage representative or broker. You can, however be certain to keep track of the insurance coverages selected by you and offered by insurance firms to make a fair contrast. Conversely, you can that can aid you find the very best combination of price as well as fit (auto insurance).

Independent agents benefit multiple insurer and also can contrast amongst them, while captive agents help just one insurance provider. Provided the different ranking approaches as well as elements utilized by insurers, no solitary insurer will be best for everyone. To much better comprehend your normal auto insurance policy cost, invest a long time contrasting quotes throughout business with your picked method.

These are example rates and ought to just be made use of for comparative objectives. Rates were determined by assessing our 2021 base profile with the ages 18-60 (base: 40 years) used. Depending upon age, vehicle drivers might be a tenant or home owner. Prices for 18-year-old are based upon a driver of this age that is an occupant (not a home owner) as well as on their very own policy.

low cost automobile insurers cheap auto insurance

low cost automobile insurers cheap auto insurance

Washington State presently allows debt as a rating variable, but a restriction on its usage is presently on hold in the courts (vehicle).

Some Of Average Car Insurance Cost Per Month - Autoinsurance.org

Four points to consider when choosing the quantity of coverage for your requirements: The worth of your properties What you drive Just how much you drive Who's in the automobile with you In a lot of states, you're needed to bring a minimum amount of responsibility insurance and additionally give proof of insurance policy prior to you can register your vehicle or restore your motorist's permit.

If that is the situation, the legitimately liable driver will have to pay the additional costs expense. Think about the adhering to when picking Auto insurance policy protection:.

That's exactly how easy it is. With My, Plan, you can see your policy online as well as make changes or revivals. Use our prize-winning The General user-friendly mobile app to execute these exact same tasks or submit an insurance claim. Do I get a price cut if I pay my policy in complete? In most states, customers paying in complete get discounts.

The expense of automobile insurance coverage can be difficult, so for several chauffeurs, it's a relief to be able to pay in month-to-month installations for the year. The majority of insurance firms offer you the choice of paying for the whole plan every year or spreading out the payments over each month, however which is the ideal option?

This is exceptionally handy to individuals who have income that fluctuates throughout the year or is seasonal, obtain an annual reward, or obtain a tax reimbursement. accident. It can additionally be helpful for individuals that have difficulty staying up to date with month-to-month settlements. Paying the insurance premium yearly might conserve you money if you normally sustain late costs.

The Ultimate Guide To Mercury Insurance: Auto, Home, Business Insurance & More

Nonetheless, the majority of business bill an installation fee for this benefit given that it takes more job on the business's part to process 12 payments instead of simply one. Even with a month-to-month fee, paying in regular monthly installations is a much better option for some individuals. It permits you to spread out the price of the costs out with time as most individuals spending plan their cash on a month-to-month basis.

prices trucks insurance affordable cheap auto insurance

prices trucks insurance affordable cheap auto insurance

If you expect a significant change in your policy before the year is up, like getting rid of a teenage motorist from your policy, you'll want the capacity to take them off the policy and also see immediate cost savings. Regular monthly payments may likewise be a great choice for a person that may have the cash to pay an annual premium yet wishes to spend the additional money or use it for one more large cost (cheaper car).

Another determinant is the amount of financial savings you'll enjoy if you do make a swelling sum payment. It may not be worth it if you conserve $30 a year in costs.

Some business additionally give you a discount rate if you established up automatic repayments with them. Not just can this alternative obtain you a discount, however you'll never have to fret about paying that expense monthly. Frequently the price cut you obtain for digital or automated settlements offsets any type of installation fees you might pay every month, so if you're vacillating between annual or month-to-month payments, figure out if any of these price cuts is offered (cheap car insurance).

Eventually, you want to locate a repayment method for your automobile insurance that creates an equilibrium between conference personal choices and also conserving you one of the most money while offering you the vehicle insurance security you need.

The Ultimate Guide To Should You Pay Car Insurance In Full Or Monthly? - Experian

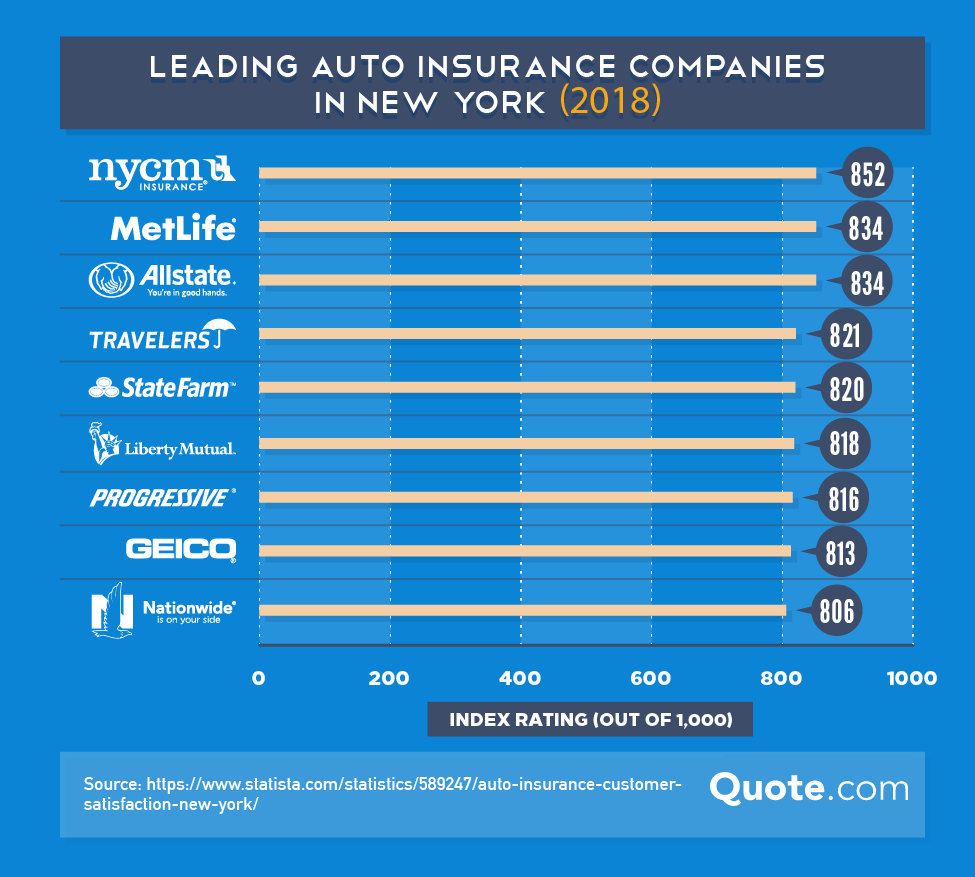

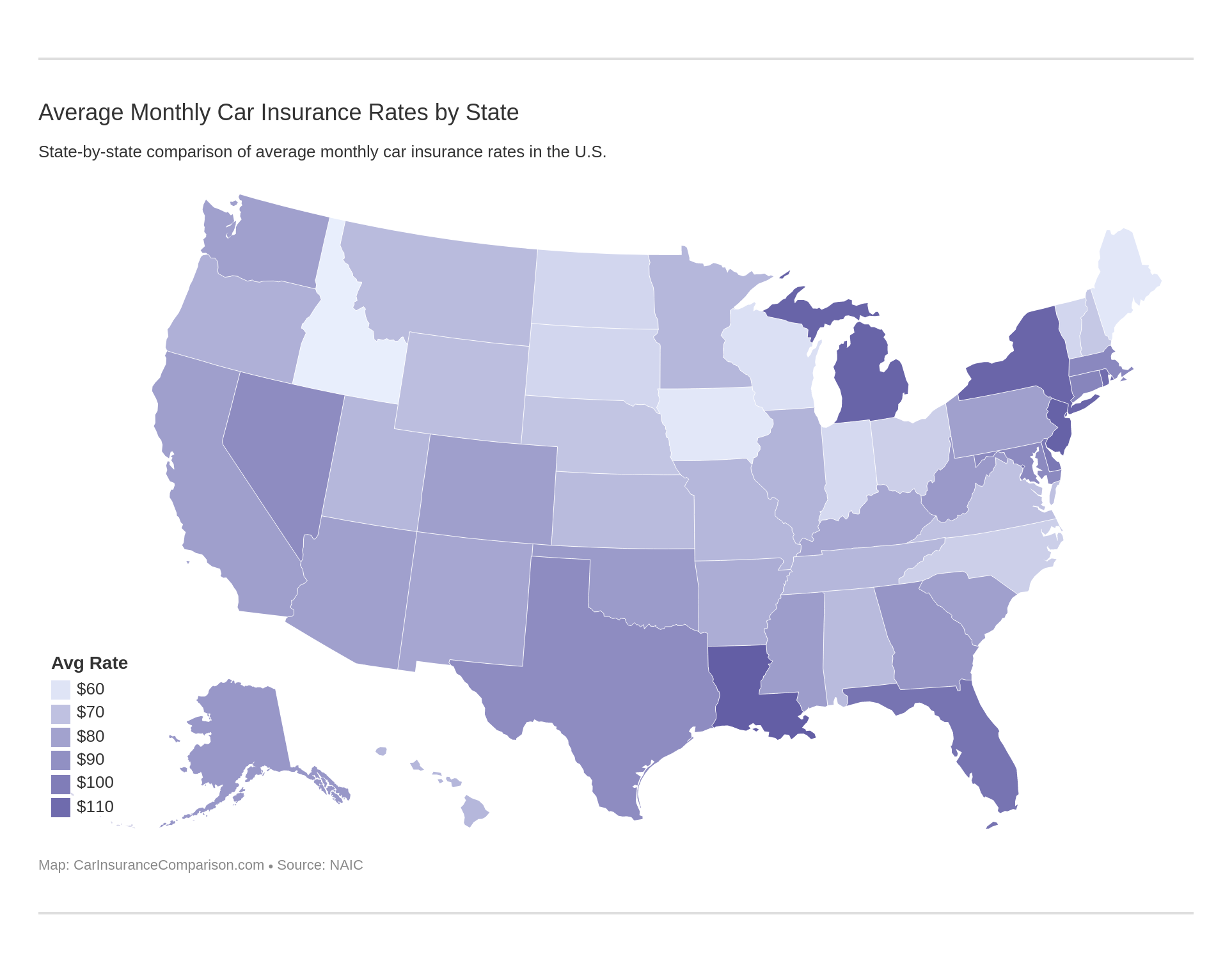

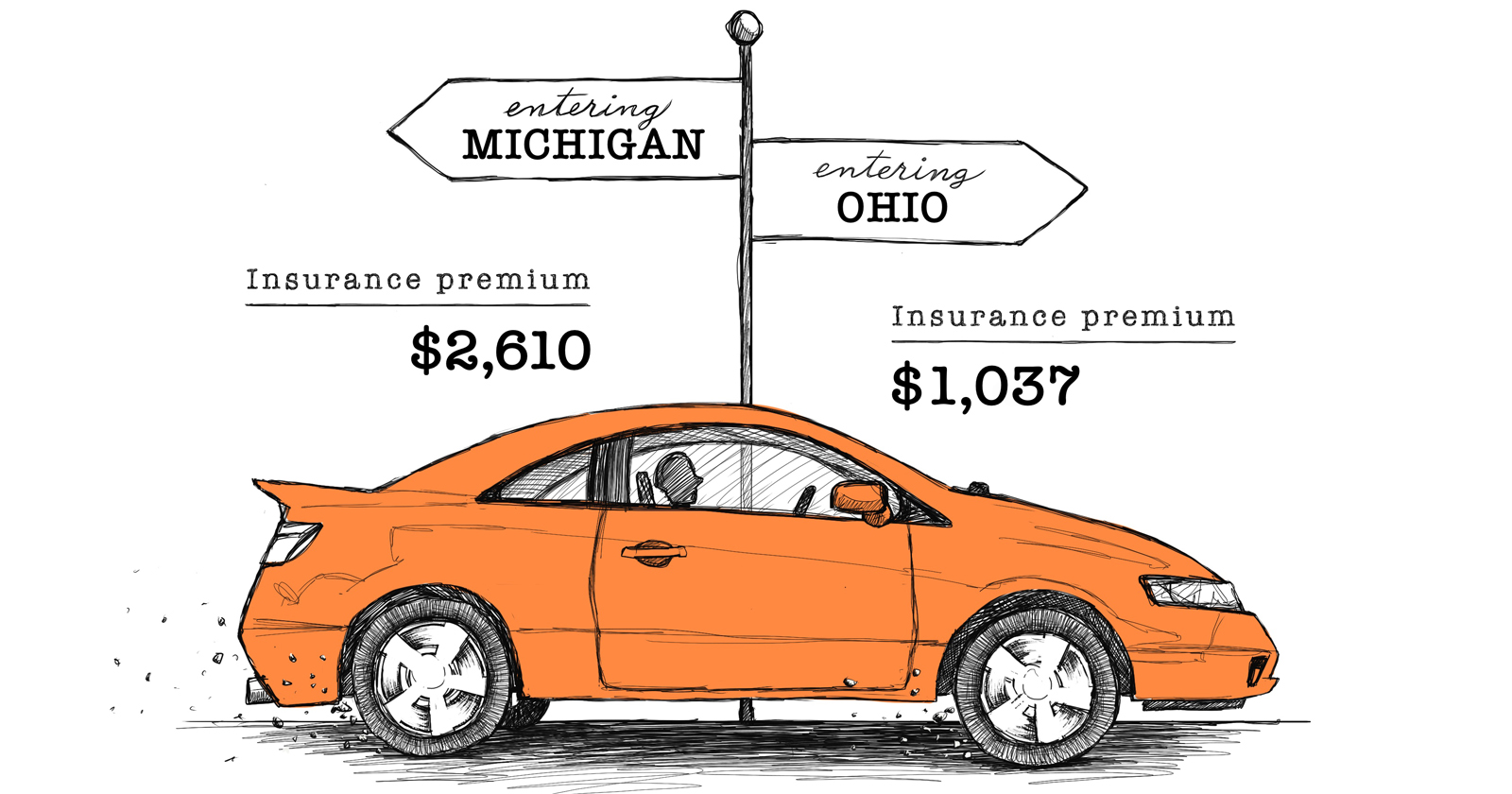

The average expense of car insurance policy in the United States is $2,388 annually or $199 per month, according to information from virtually 100,000 insurance holders from Savvy (affordable car insurance). The state you stay in, the level of protection you would love to have, as well as your gender, age, credit rating, as well as driving history will certainly all aspect right into your premium.

Vehicle insurance plan have great deals of relocating parts, and also your premium, or the cost you'll spend for coverage, is simply one of them. Insurance is controlled at the state degree, and also laws on called for protection and rates are different in every state - affordable. Insurer think about several aspects, consisting of the state and area where you live, in addition to your sex, age, driving background, as well as the degree of protection you wish to have.

business insurance vehicle insurance cheapest auto insurance cheapest

business insurance vehicle insurance cheapest auto insurance cheapest

Here are the biggest factors that will certainly influence the price you'll pay for protection, as well as what to consider when looking at your vehicle insurance policy options. There have actually been some huge adjustments to automobile insurance policy prices during the coronavirus pandemic.

Organization Expert assembled a checklist of average auto insurance policy prices for each state. These prices were figured out as approximately prices reported by Nerdwallet, The Zebra, Value, Penguin, Bankrate, as well as the National Association of Insurance here Policy Commissioners. Here's a variety car insurance coverage costs by state. Resource: Data from Nerdwallet, Worth, Penguin, Bankrate, The Zebra, as well as the National Organization of Insurance Commissioners.

And Also from Company Expert's data, vehicle insurance provider have a tendency to bill ladies extra. Organization Expert collected quotes from Allstate and State Farm for standard insurance coverage for male as well as women vehicle drivers with a the same account in Austin, Texas (affordable). When switching out just the sex, the male account was priced estimate $1,069 for coverage per year, while the women profile was estimated $1,124 annually for insurance coverage, setting you back the woman vehicle driver 5% more.

The 20-Second Trick For How Much Is Car Insurance For 25-year-olds? - Coverage.com

In states where X is a gender option on motorist's licenses including Oregon, California, Maine, and quickly New York insurance providers are still figuring out just how to calculate expenses. Average cars and truck insurance policy costs by age, The variety of years you have actually been driving will certainly influence the rate you'll spend for insurance coverage. While an 18-year-old's insurance policy averages $2,667.

This data was provided to Organization Insider by Savvy. Exactly how vehicle insurance policy costs alter with the variety of autos you possess, In some ways, it's rational: the extra cars you carry your plan, the higher your car insurance expenses. There are also some financial savings when several vehicles are on one plan.

Automobile insurance is cheaper in postal code that are a lot more rural, and also the very same holds true at the state level. Guarantee. com data reveals that Iowa, Idaho, Wisconsin, as well as Maine have the most inexpensive auto insurance policy of all states, and also that's due to the fact that they're much more country states. Various other aspects that can affect the price of cars and truck insurance coverage There are a couple of other aspects that will certainly add to your costs, consisting of: If you don't drive lots of miles each year, you're much less most likely to be associated with a mishap.

Each insurance company looks at all of these elements and prices your protection differently as an outcome. Obtain quotes from several various auto insurance business and compare them to make sure you're getting the finest deal for you - cheaper car insurance.

If you're driving, you additionally need to have automobile insurance policy. No one believes regarding shopping for vehicle insurance.

Unknown Facts About What Is The Average Cost Of Auto Insurance? - Moneygeek

The basic reality is, automobile insurance coverage for university pupils can make up a substantial component of your restricted spending plan. As well as vehicle insurance policy prices alter all the time. insurance affordable. And also, the typical expense of cars and truck insurance policy for a 20 year old is $3,816 per year, or $318 per month!

That's the average for everybody. The average price for college students is approximately $3,816 per year, or $318 per month.

This settlement may impact how as well as where products appear on this site (including, for instance, the order in which they appear). The College Capitalist does not include all insurance policy firms or all insurance supplies readily available in the market. Our # 1 pick for the most inexpensive automobile insurance coverage for college pupils is Freedom Mutual The reason could shock you.

https://www.youtube.com/embed/tBBTKA1zL-M

When you incorporate vehicle insurance policy with tenants insurance policy, you get a multi-policy price cut, which saves you a great deal of cash. Compare General Automobile Insurance Policy For College Pupils, Here's our full contrast list for car insurance for university students. Most Significant Variables To Take Into Consideration When Buying For Cars And Truck Insurance, Shopping for automobile insurance policy is challenging since there are so numerous variables entailed in what cost you pay.

Some Of Does Taking Defensive Driving Lower Insurance - Yourpace ...

Related Products & Discounts Obtain protection that can aid provide you comfort when you get on the road - prices. This obligation coverage may exceed as well as beyond your automobile and also house insurance coverage to help protect you from unforeseen events. See just how packing multiple plans as well as a secure driving background can make all the difference on your monthly premium.

Given that car insurance policy service providers are looking to make money from their services, they'll try to discover ways to make even more cash off you. As a result, you might discover on your own paying costs that are a bit greater than you think they must be.

Contact your auto insurance supplier and attempt to work out a better price. You can keep vehicle insurance coverage prices low by simply altering service providers or bargaining rates every couple of years (cheaper).

Raising your insurance deductible can save you so much money on costs that you'll likely still spend less cash every year, also if you hit your insurance deductible during the year., though you often have to ask about them.

If you wind up requiring to sue yet you're not fully covered, your claim can be denied. Skip the payment plans Layaway plan can assist a great deal of people by expanding the cash that needs to be spent on insurance. insurance company. The disadvantage is, the majority of auto insurance provider charge even more money if you pay in installments than if you pay for your insurance coverage simultaneously.

How To Reduce Your Auto Insurance Premiums for Dummies

Having auto insurance coverage is crucial, yet prices usually increase over time as well as it prevails to pay too much (auto insurance). None of these suggestions will certainly make your automobile insurance totally free, yet they can make it more economical to ensure that you can get the protection you require for a reasonable cost. Locate reduced premiums with Jerry The outright quickest way to change your costs is to change insurance carriers.

In this write-up: In the existing economic uncertainty surrounding the COVID-19 pandemic, you might be taking a look at different methods to reduce your expenses. One method you can conserve cash is by reducing your automobile insurance premiums (cheap insurance). With fewer Americans on the roadway, some car insurance provider are providing a wide range of discount rates, several of which will let you start conserving money immediately - cheap car.

Call Your Insurance Policy Agent, Start by contacting your present auto insurance policy business to ask exactly how you can trim your premiums. cheap. Have a duplicate of your insurance coverage ready so you can see specifically what your current insurance coverage consists of. The insurance agent should be able to recommend several alternatives.

liability prices cars affordable auto insurance

liability prices cars affordable auto insurance

, understand that the expense of insurance policy can vary widely depending on your vehicle. Some cars and trucks are more intricate to repair, a lot more prone to theft or even more conveniently harmed than others.

It's an excellent suggestion to check your credit rating when looking for automobile insurance and, if needed, take steps to improve it. Paying your costs in a timely manner is the biggest element in your credit rating, but there are a number of other steps you can take to raise your credit ratingand possibly reduce your vehicle insurance policy costs. If you're renting a car, it can be an excellent suggestion to obtain gap insurance coverage, which pays the difference between the worth of the vehicle as well as the quantity you owe on your lease in case the vehicle is swiped or amounted to in a mishap. Regardless of just how much you're presently spending for car insurance policy, reviewing your insurance policy yearly can assist you identify methods to conserve.

The Only Guide to I'm Not Driving Much These Days. How Can I Lower My ...

What's the ordinary cost of automobile insurance? Why am I paying so a lot for automobile insurance coverage? What affects my automobile insurance policy price?

What's the Average Price of Vehicle Insurance? You may already be conscious of this, yet automobile insurance coverage varies from person to person due to variables such as make and also model, kind of car owner, model year, your driving history, specific insurance policy protections chosen, location (i. cars.

/images/2022/01/27/happy-man-in-car.png) insurance cheaper car insurance cheapest car insurance auto

insurance cheaper car insurance cheapest car insurance auto

where you live, city, state, climate)Environment and your and also, debt other specifics., the average expense of complete protection auto insurance policy in the United States as of 2021 is $1,592 a year, or about $133 a month.

insurance affordable cheap car car insurance car

insurance affordable cheap car car insurance car

Why Is My Vehicle Insurance Expensive? Your cars and truck insurance is a representation of you. car.

5 Things You Must Do To Reduce The Cost Of Car Insurance Fundamentals Explained

DUIs have a significant negative impact on your insurance policy, and in some situations, it can actually void your insurance coverage. While that contrast may be out of the world of reality for a lot of, it stands as an excellent example of how the make, version, as well as type of automobile affect your premium.

Choosing Greater Deductibles, When choosing coverages, you can additionally choose greater deductibles to reduce your month-to-month price. By doing so, you boost the amount of out-of-pocket costs in case of a crash. There are pros and also cons to this, as not everybody will have a few thousand bucks in savings if the most awful were to occur (cheaper car insurance).

insurance auto insurance auto prices

insurance auto insurance auto prices

Exactly how a lot you invest on vehicle insurance coverage will certainly depend on the coverages you select, the variables above, as well as which insurance service provider you go with. See what you can conserve on auto insurance policy, Conveniently contrast tailored rates to see how much changing car insurance coverage might save you. Take advantage of car insurance discount rates, Every insurance coverage firm uses unique methods to save on your car insurance coverage premium.

To ensure you're obtaining all the discount rates you're entitled to, take a look at your insurance company's discounts page as well as ask your agent to assess your feasible financial savings. Our cars and truck insurance coverage discount rates web page offers even more details on what insurance providers supply various discounts. If your cars and truck is worth less than your insurance deductible plus the quantity you pay for yearly coverage, then it's time to drop them. Crash and also detailed never pay out greater than the car deserves. Review whether it deserves paying for insurance coverage that might compensate you just a little quantity if anything. Put it in a fund for car fixings or a deposit on a more recent automobile when your car conks out. See what you might save money on auto insurance policy, Easily contrast personalized rates to see how much changing car insurance policy could save you. 5. Drive a vehicle that's economical to insure, Before you buy your next vehicle, contrast cars and truck insurance policy prices for the versions you're taking into consideration. Safe as well as moderately priced vehicles such as little SUVs tend to be more affordable to insure than flashy and costly cars - insured car. 6. Boost the insurance deductible, You can conserve money on crash and comprehensive insurance coverage by elevating the insurance deductible, the amount the insurance business does not cover when spending for repairs. suvs. For example, if you have a$500 deductible as well as your repair bill is $2,000, the insurance firm will certainly pay out$1,500 when you have actually paid the $500. 7. Improve your credit score, Your credit report can be a big aspect when automobile insurance firms calculate just how much to charge. It can count much more than your driving document in many cases. This isn't the instance in California, Hawaii, Massachusetts and Michigan, nonetheless, where insurance companies aren't permitted to consider credit history when setting prices. It's feasible to obtain a discount rate just for authorizing up for several of these programs, so they may look like a piece of cake. Some insurers may raise your rates if you're considered a dangerous chauffeur. Make certain to check what habits are tracked and also just how your price is influenced prior to enlisting

Top 10 Ways To Lower Your Car Insurance Bill -- Edmunds.com Things To Know Before You Buy

https://www.youtube.com/embed/bgurovcDPT01. Recognize your present insurance coverage, The first point you wish to do is recognize your present cars and truck insurance plan. You desire to see where you currently stand, so you can examine whether the coverage and limitations you originally acquired are still the right suitable for you. You might have bought your policy when your way of living was different. Undoubtedly, every single time you start your vehicle as well as get on the road, there's a level of danger. So naturally, if you drive less, there's less threat . So why not reward on your own for that and also pay less for insurance at the same time? Making use of pay-per-mile insurance coverage, you can do simply that. Make certain to inspect among numerous cars and truck insurance policy providers to see possible rates. You can consider typical auto insurance policy vs. pay-per-mile insurance as well as examine what is ideal for your distinct circumstance. 4. Make a button and also downsize your car Here's something you might not want to hear. Check out here The type The kind ofautomobile you have can be setting you backyou much more. If anything were to take place, the substitute expenses would likely be greater. Additionally, prices can be higher with bigger vehicles as a result of the prospective damage done to other vehicles in case of a mishap. If you scale down to a smaller sized or even more fuel-efficient automobile, your car insurance prices may be reduced. Raise the deductible, If you have a good driving document and extremely hardly ever enter crashes, you can boost your insurance deductible to conserve money on your cars and truck insurance. You normally pay more for cars and truck insurance coverage if you have a lower deductible. Your insurance deductible is exactly how much you require to pay prior to your insurance policy kicks in.

See This Report on Compare Car Insurance Quotes & Get Your Best Rate - Experian

Right here are the providers that often tend to offer cheap automobile insurance coverage for vehicle drivers with poor debt according to our price quotes. Most affordable car insurance policy estimates for 24-year-old drivers Being a young chauffeur will raise your rates (car). Right here are the most affordable typical complete insurance coverage prices for 24-year-old chauffeurs according to our price quotes - insurance.

laws cheaper auto insurance accident cheap auto insurance

laws cheaper auto insurance accident cheap auto insurance

We gathered information on dozens of auto insurance providers to quality the firms on a vast array of ranking aspects (vehicle insurance). Completion outcome was a general score for every company, with the insurance providers that racked up one of the most factors topping the listing - low-cost auto insurance. Below are the elements our rankings consider: Cost (30% of overall rating): Automobile insurance rate quotes generated by Quadrant Info Services as well as price cut chances were both considered.

Interpretation as well as Instances of Car Insurance coverage Prices quote Car insurance coverage quotes are estimates of just how much you will certainly spend for a certain kind and amount of vehicle insurance policy coverage based upon the information you provide.: Automobile premium quote, vehicle insurance quote, auto quote You can gather quotes from different vehicle insurance firms via representatives or via websites prior to you decide which insurance policy is appropriate for youand they are totally free.

You can ask various other insurance companies what it would certainly cost for the exact same insurance coverage, after that contrast those quotes to discover the finest rate. Quotes are commonly for 6 months or 12 months of coverage.

How Automobile Insurance Policy Quotes Job What occurs when you request a quote from an agent or through an insurer's internet site? Let's examine the quote process from both the insurance company's and also consumer's perspectives - affordable auto insurance. Quotes from the Insurer's Point of view Quotes are based on the insurance provider's preliminary estimation of your threat as a chauffeur, in mix with any type of discount rates you might certify for - laws.

Getting The Car Insurance Quotes, Tips, And Savings – Carinsurance.org To Work

In some states, insurers can take your credit scores background into account. In various other states, insurance providers aren't enabled to consider your credit report. In general, these elements might influence your quote: Your driving record, marital standing, sex, as well as age Your place and exactly how you utilize your car Previous insurance coverage Any type of price cuts you get approved for (such as combined auto and home protection) Your choice of insurance deductible Optional coverage, such as rental cars and truck compensation protection Insurers consider factors differently, so their quotes will vary.

Quotes from the Consumer's Perspective When you obtain a quote, specify concerning what kind of car insurance coverage you require and also discuss any type of worry about the representative. The California Department of Insurance recommends staying clear of asking for "the most effective insurance coverage," as the agent will rate what you require. Stay clear of asking for "complete coverage," which isn't a real type of insurance coverage (prices).

You'll need to supply either the agent or an online website with several pieces of info like your date of birth, car's VIN, your driving background, and other individual details. laws. Have these information handy when gathering auto insurance coverage quotes - vehicle. Providing your Social Security number may be optional for getting a quote, but helps the insurance firm to validate your identification and also offer you with a much more exact quote.

See to it you understand what's optional as well as what isn't in your state Consider event at the very least 3 to four quotes for the same insurance coverage and also with the exact same deductibles as well as price cuts. With this details, you can much more accurately compare expenses along with client service methods. If you obtain a quote on the phone, ask the representative to send you the quote in creating.

If you find errors, ask for a modification in writing. The quote you receive may be different from the real policy rate, specifically if you provide info that is different from the main records the insurance provider reviews - insurance companies. Quotes can transform based on new or updated information you offer or the insurance provider discovers.

Some Ideas on Car Insurance Quotes Vs Rates You Need To Know

The cost of your policy can also change if you alter your protection options - vehicle insurance. Before you wrap up your insurance coverage, telephone call or check the internet site of your state's insurance regulator to make certain the representative is accredited. Trick Takeaways A car insurance quote is a price quote (tentative) of the quantity you'll spend for a plan period.

suvs cheapest car insurance cheapest car insurance vehicle insurance

suvs cheapest car insurance cheapest car insurance vehicle insurance

Consider getting quotes from at the very least three insurance providers, whether with an internet site or with an agent. Insurance coverage companies might change their priced quote price with new details, consisting of information they get from driving records. Often Asked Inquiries Exactly how do I obtain a free quote for vehicle insurance coverage? Auto insurance coverage quotes are usually totally free, whether offered online, by phone, or face to face with an agent.

vehicle insurance automobile cheap auto insurance low cost auto

vehicle insurance automobile cheap auto insurance low cost auto

low-cost auto insurance cheapest car insurance affordable business insurance

low-cost auto insurance cheapest car insurance affordable business insurance

If you desire an insurance coverage plan that starts right away, a breakthrough quote price cut may not be offered. Can I get an auto insurance policy quote without having an auto?

The pandemic has actually changed the means lots of individuals utilize their cars. If you're working from home extra, as an example, you might be using your auto much less. This implies you could have a reduced annual mileage, or your car is kept at a various area throughout the day than where you stated in your automobile insurance plan.

If your auto insurance coverage is Find out more up for renewal, it deserves checking all your information to make certain that they still mirror how you drive. For example, if you're currently driving less, or aren't travelling, your insurance costs could be lower. If your occupation has altered, for instance if you've come to be out of work or now have a sideline, you ought to inform your insurance provider - auto insurance.

Some Known Incorrect Statements About Free Car Insurance Quotes - Bankrate

Some of them are as adhere to: 1. Kind of the Strategy The costs of the strategy relies on the insurance coverage chose (cheap). Bigger the protection, the greater the premium. There are 3 fundamental types of cars and truck insurance coverage based upon the coverage they provide: This sort of insurance policy is required and also covers the cost of 3rd party liabilities consisting of physical injuries, fatality as well as residential property damages.

At Insurance policy, Dekho we have actually developed a variety of write-ups to help you hereof. Click below to review them. Recognizing the essentials of automobile insurance will help you comprehend what your insurance coverage requires specifically are (prices). There are a variety of guidelines you can utilize to identify the credibility of the insurance coverage service provider.

We generally make insurance claims in times of distress as well as a non-efficient claim process can contribute to your disappointments at such a time. A lot of the insurance policy is in the small print. cheapest car insurance. Therefore, make certain to read the policy you choose very carefully, there are commonly a variety of things that are not covered discussed there that can make the plan a negative bargain.

Keep in mind reduced premiums likewise mean reduced protection or high deductibles, this can prove extra expensive in the lengthy run. How to Contrast Cars And Truck Insurance Coverage Quotes Online on Insurance, Dekho?

The 5-Second Trick For Can I Sue For More Than The Defendant's Insurance ... - John Foy

A seasoned vehicle accident attorney comes with the lawful competence as well as useful knowledge bordering vehicle accidents. He/ she will be able to observe and also disclose the not-so-obvious or ignored components in the crash and also give a brand-new angle to the instance (auto). You can rest in the understanding that your legal representative will certainly be functioning only with your benefits in mind.

Such evidence-based truths will reinforce your instance against the at-fault celebration. car insurance. Conduct In-Depth Investigation right into the Situation If you are target with injuries in the vehicle accident, after that it can be hard for you to make certain an unbiased evaluation of realities at the mishap scene (cheap car). The shock of the injury can affect your memory of events. insure.

An experienced mishap lawyer can construct a solid instance making use of reputable evidences acquired versus the various other event to persuade the jury to give you optimal payment - cars. Bring Realities to the Negotiation Table When you decide to go with a car crash negotiation and also start arrangements, you get control over the procedure just with strong evidence against the other event - cheaper cars.

Insurer that do not act in good confidence may get statements that can weaken your instance that the various other party is at fault. These statements may make you seem at least partly, if not totally, in charge of the accident. A competent crash attorney can recognize if an insurance provider is acting in great belief.

When Your Car Accident Claim Exceeds Insurance Policy Limits Can Be Fun For Anyone

cheapest car cheapest auto insurance cheap insurance companies

cheapest car cheapest auto insurance cheap insurance companies

It is very easy to require more compensation than your problems absolutely necessitate. It is important to assess mishap damages the method they should be, and designate the best weight age to them.

Inaccurate analysis can additionally cause under-valuing of your damages. You might end up asking for a lot less than the actual damage. This blunder can enhance your clinical as well as other expenditures in today. It can also verify pricey over time, specifically if you have incurred a resilient damage such as an injury, due to the accident.

Demand letter blunders. A need letter (clarified in detail in the earlier areas of this post) is a critical component to a vehicle crash settlement procedure. It is the demand letter that opens arrangements for settlement (car). A well-drafted demand letter provides the ideal opportunity to put forth your case as the hurt celebration as well as insurance claim rightful payment.

Not specifying mishap problems plainly. The need letter must provide information pertaining to the losses you have encountered due to the mishap.

Not known Facts About How Often Do Car Accidents Exceed Policy Limits? - Wells ...

Your need letter should be polite. The attorney of the opposing celebration will certainly see it for what it is a vacant hazard that can be used against you.

cheap insurance companies car cheapest car

cheap insurance companies car cheapest car

trucks car insurance cheap suvs

trucks car insurance cheap suvs

Also if you choose to file a suit, the demand letter can be submitted as proof (prices). The harsh tones of the https://tiny.one/mr3myra5 letter are not going to make you look like a target to the jury.

Before approving, make certain once more that the offer covers all your clinical expenditures consisting of existing and future, and other damages that you may have suffered. Authorizing the Launch in rush When you accept a deal from the at-fault party, the insurance firm will ask you to authorize a Launch record - vehicle. The insurer will not provide your negotiation check unless you authorize this launch record (credit score).

insurance car insurance cheaper auto insurance car insurance

insurance car insurance cheaper auto insurance car insurance

cheapest car auto business insurance low cost

cheapest car auto business insurance low cost

https://www.youtube.com/embed/onLKk1dQOlg

An injury lawyer waits till the period suggested by your physician to assess your injuries properly. He/ she delays the settlement till you recoup to the maximum, from your injuries.

How Understanding Auto Insurance can Save You Time, Stress, and Money.

vehicle money accident insured car

vehicle money accident insured car

Automobile insurance policy obligation coverages might be provided in a collection of numbers stating the quantity covered for injury per individual, per accident, and also total residential or commercial property damages. If you own an automobile, you will certainly need vehicle insurance coverage that fulfills the legislations in your state.

:max_bytes(150000):strip_icc()/Who-will-my-auto-insurance-check-claim-be-made-out-to-527131-v2-f4edb97fee6f488d969226528a1b55d0.png) insurance affordable affordable cheap insurance affordable

insurance affordable affordable cheap insurance affordable

4 basic kinds of coverage may be in your state's laws. You may require bodily injury liability, defined per individual as well as per crash. States might purchase you to have home damages responsibility (likewise per mishap). State regulations could additionally call for personal injury security (each as well as per mishap).

You might see $20,000/$40,000/$15,000, or 20/40/15. This provides physical injury responsibility of $20,000 per person as well as $40,000 per crash, and building damage obligation would certainly be $15,000 per accident.

New Hampshire does not mandate that you purchase auto insurance to drive. You'll also require to pay for any type of property damages you trigger. This suggests you'll need a large financial savings account if you do not have insurance coverage.

How quickly do you need to get insurance coverage after acquiring an utilized auto? In most states, it's prohibited to drive any kind of vehicle without required insurance coverage. States set grace periods for insuring a just recently acquired car. Generally, you can anticipate to have in between a week and also a month to get insurance after acquiring a made use of vehicle. risks.

How Frequently Asked Questions – Automobile Insurance can Save You Time, Stress, and Money.

The 1978 Diplomatic Relations Act and also the Foreign Missions Act call for that all Motor Autos owned and operated in a united state Jurisdiction by a participant of the Foreign Goal Community lug obligation insurance policy coverage in all times (cheap insurance). It is the responsibility of all International Goals to offer OFM with created proof of continual insurance policy protection.

A copy of an insurance company's binder, valid for at the very least 30 days from the day of application 2. Keep in mind: There are no insurance requirements for trailers, which are covered by the insurance coverage plan of the lugging lorry.

As soon as signed up, obligation insurance policy need to be kept for the signed up Motor Lorry(s) in any way times as set forth listed below. OFM needs to be alerted every time there is a change, update, renewal or termination to the responsibility insurance coverage (cheapest car). OFM carries out evaluations and also audits the Click here Foreign Goal Area to make certain conformity.

car insurance liability cheap car insurance cheapest car

car insurance liability cheap car insurance cheapest car

Participants with Insurance Policy Protection: Participants of the Foreign Objective Neighborhood that have actually signed up Electric motor Automobile(s) with OFM might already have liability insurance coverage that would cover rental Automobile(s) via their existing plans. Participants of the Foreign Mission Neighborhood ought to confirm that their insurance coverage plan covers rented Car(s). Members without Insurance Policy Insurance Coverage: Participants of the Foreign Mission Area who do not have Automobile(s) signed up with OFM, and do not have actually the mandated minimum level of liability insurance protection need to acquire such minimum coverage before the operation of rental Electric motor Vehicle(s) in any kind of U - vans.S

This protection might be acquired through the rental firm. Warning: Failure to conform with these requirements could lead the Department of State to take major activity versus the privilege to operate Automobile(s) in the United States. Additionally, regardless entailing an accident or injury, the Division of State intends to ask for an appropriate waiver of immunity if valid claims are not satisfied.

or Canada, PIP covers you and relatives who reside in your house. In this situation, you need to be driving your own vehicle. cheaper car insurance. Individuals besides you or your relatives are not covered. (back to cover) Residential or commercial property damages obligation insurance pays for damages that you, or members of your family members, create to another individual's residential property while driving.

1, 2007, you have to have $100,000 well worth of coverage per person and also $300,000 worth of coverage per accident. You likewise need to have a minimum of $50,000 in building damage coverage. BIL pays for major and long-term injury or fatality to others when your automobile is included in a mishap and also the motorist of your automobile is located to be at mistake to some degree - insured car.

low-cost auto insurance perks cars cheapest auto insurance

low-cost auto insurance perks cars cheapest auto insurance

Crash insurance coverage spends for repair services to your auto if it rams an additional vehicle, accidents right into a things or passes on. It pays no matter of that creates the crash. Collision insurance does not cover injuries to individuals or damage to the residential or commercial property of others. Detailed insurance coverage pays for losses from incidents besides a collision.

Without insurance vehicle driver () insurance policy pays if you, your travelers or relative are struck by someone who is "liable" and does not have insurance policy, or has inadequate responsibility insurance policy to cover the complete problems endured by you (cars). This applies whether you are riding in your vehicle, riding in another person's auto or are struck by a vehicle as a pedestrian.

Auto Insurance Fundamentals Explained

insured car insured car auto affordable car insurance

insured car insured car auto affordable car insurance

If you have accident coverage or home damage obligation, you may be covered for damages to rental vehicles driven by you, depending on the terms of your plan. You likewise might be automatically covered by your bank card company if you made use of the card to rent the vehicle. car insurance.

(back to cover) Car service warranties are good just for a specified length of time and make sure only the repair or substitute of items defined in the agreement (cheaper car). Solution guarantees are contracts that are controlled by the Division of Financial Solutions. Whether a service warranty deserves the money will certainly depend on just how the service warranty suits your needs.

Make sure to ask for the same protection from each so your contrasts will certainly be accurate - car. A quote is a price quote of your premium it is not a firm cost or a contract. It is against the law for an agent to deliberately estimate you a low premium simply to obtain your company.

Incorrect or unreliable info can create the business to terminate your policy or refuse to pay an insurance claim. Constantly obtain a duplicate of the signed application form. Be sure to obtain a binder from the agent as soon as you authorize the application - insurance company. A binder is your short-term evidence of insurance policy till a formal policy is released.

Make checks or money orders payable to the insurance policy company never ever to the representative or the firm. If you do not obtain your plan, contact your representative.

About What You Need To Know - Minnesota Department Of Public Safety

This required coverage will certainly not cover you if you are injured in a motorbike mishap. Nevertheless, some insurance coverage companies might supply PIP and medical payment insurance policy for motorbikes as added coverage that can be bought - vehicle insurance. In order to run or ride on a motorcycle without headgear, you must more than 21 years old and also have an insurance coverage giving a minimum of $10,000 in clinical benefits for injuries endured as a result of a collision.

https://www.youtube.com/embed/OjlOAPIeh-s

Lastly, remember these ideas: Read your policy. Make certain you understand your policy. If you have any concerns, call your representative or the Division of Financial Providers toll-free at 800-342-2762. The option of insurance coverage business as well as agent is yours. You do not have to purchase car insurance from the supplier who sold you the auto or the loan provider funding your car.

The Best Guide To Teen Drivers & Car Insurance Costs - Devaughn James Injury ...

$2139 six-month costs or $357 monthly. $2401 six-month premium or $400 each month. $2528 six-month costs or $421 each month. It is relevant to discuss that the insurance coverage rates above are for minimal coverage. One have to think about how much insurance coverage they might need and also the insurance deductible they are prepared to pay without any economic crisis.

How to get the finest vehicle insurance for 16-year-old chauffeurs Obtaining the ideal auto insurance coverage for a 16-year-old is crucial because it guarantees security and economic safety (affordable). Despite the fact that auto insurance for teenagers can be costly, you can often find alternatives to fit your spending plan without giving up coverage - vehicle. One of the finest means to do this is to go shopping around and obtain quotes from numerous insurance business.

cheap vehicle insurance car insurance auto

cheap vehicle insurance car insurance auto

While looking for a car insurance coverage plan, one need to be interested in taking into consideration offered coverage types, discounts, client satisfaction scores, and also monetary strength (auto). Comparing these factors, along with rate, may assist you locate protection that fits your requirements. affordable car insurance. Web traffic statistics for 16-Year-Old motorists Adolescent drivers have a tendency to set you back more to insure due to the fact that they are much more likely to enter mishaps and have a reason to utilize their insurance coverage.

According to data for police-reported collisions, chauffeurs aged 1617 were associated with almost double the variety of fatal collisions than 18- as well as 19-year-olds for every single 100 million miles driven. cheap insurance. The young vehicle drivers behind the wheel are at a greater threat for crashes. And there are fewer fatalities per capita for teenagers than for older drivers (cheapest auto insurance).

At the age of 17, the insurance is not as pricey as it is for a 16-year-old, however still, it is a significant amount. The national yearly typical rate for a 17-year-old is just over $5,370 for complete coverage and also $2,206 for minimal coverage (laws). Besides Hawaii, North Carolina has the lowest typical yearly rate for a full-coverage policy for a 17-year-old at simply under $2,660.

Louisiana has the highest possible ordinary overall protection rates for 17-year-olds Can teens have their car insurance coverage? Young adults are minors, and also because of the fact they are underage, they generally are not allowed to have their auto insurance plan (cheaper car). They will be detailed as vehicle drivers on their parent or guardian's policy.

Things about Teenage Male Vs. Female Car Insurance Rates

Nonetheless, it can be financially useful to remain on a moms and dad or guardian's policy until they vacate and also establish their household. Final thought The bottom line of the discussion is that the rate of your auto insurance coverage will rely on where you live and also whether you get Check over here your plan or have your name included to a parent's policy.

auto perks cheapest auto insurance insure

auto perks cheapest auto insurance insure

If the adolescent vehicle driver does not intend to wait, they can get contributed to their moms and dad's insurance plan - trucks.

Every little thing You Want to Know Discovering to drive is something every teen looks onward to. We assume driving can be enjoyable as long as you learn the fundamentals as well as act responsibly.

cars cheapest car insurance company insurance company

cars cheapest car insurance company insurance company

And also liable driving can help keep your auto insurance rates low. Automobile Insurance as well as Accidents Save on Auto Insurance Coverage Expenses for Teens Teen drivers will require vehicle insurance policy. Below's some extra info to aid with decisions about insurance protection for teen chauffeurs - insured car.

https://www.youtube.com/embed/u42NFCzuWro